The Adams Company.

Technology and Business-to-Business Market Research Services.

Web-Based and Traditional Research Fieldwork.

Syndicated ETA (Emerging Technology Adoption) Studies.

Business IT and Electronics OEM Technology Panels.

www.AdamsCo.com.

www.WorldInquiry.com

1420 Middlefield Rd.. Palo Alto, CA 94301. (650) 325-9822.

www.AdamsCo.com.

Click here to Download PDF printout of Adams Company Research Services Overview

Click

here to start slide show

Home

A Measurable Difference

For over ten years, the Adams Company has been bringing a singular expertise to its clients: the ability to articulate market potential. We are consultants and partners at the concept level, with an eye to understanding how the research model itself shapes the ways that marketing information is understood and acted upon.

We are experts in defining target audiences and identifying category and brand trends. We always look at the traditional classifications - location, income, profession, etc.- as the starting point for understanding how to look at buyers. On top of that, we look to identify affinities, attitudes, and belief systems- the decision-driving variables that are under the surface.

We specialize in business-to-business and technology markets. Our clients are involved with nanospeed semiconductors and global telecommunications networks. For years, we have produced syndicated industry reports tracking product purchasing patterns, brands, and media use. We have worked with a wide range of media clients, ranging from the Wall Street Journal to C Net, and Computerworld to Embedded Systems Programming.

Our syndicated work on business segmentation and emerging technology

adoption is unique. We've introduced a new framework for understanding

business motivations, processes, and response to risk. Our "adoption

segment analysis" was deliberately designed to be the most effective variable

for predicting business buying behavior for newly introduced products and

services.

Articulating Market Potential |

Identifying Market Value from Within

In some situations, the demonstration of market potential requires creative ways of showing a particular solution to a problem. To do this, research has to "frame" the buyer's market view or needs.

For our media and publishing clients, we try to identify affinities or marketing opportunities that affect buying potential. For example, for UNIX World Magazine, we did a series of brand studies. We highlighted that brand leader scores for UNIX-based market categories were very low compared to the overwhelming dominance of leading brands in the Windows/ DOS arena. For those who understood that gaining sales and market share in the UNIX market would be easier and more efficient in light of a more favorable competitive environment, the advertising choice for their advertising vehicle was already made. Go UNIX= Go UNIX World.

The key is to focus on the context of the solution, not the attributes of the product. Research can focust the context, or frame, for the decision: for example, a research-based white paper can evaluate industry responses to potential solutions in network or web systems development. Where a solution can be readily implemented using a vendor's product, the market value is inherently displayed.

Nowhere is this more relevant than for emerging technology adoption. Our syndicated ETA studies in Electronics and Business Computing clearly demonstrate that business "attitudes" and "motivations" are the critical defining points for identifying who will be first to buy emerging technologies-whether it is something as benign as upgrading a PC operating system or implementing an enterprise-wide E- Business initiative. Those who accept our emerging technology adoption concept look to our research as a frame for their marketing decisions.

Full Service Fieldwork

Of course, understanding sampling and fieldwork are critical to effectively

implementing the research concept. We offer a full range of services, from

traditional through web methodologies. For output, we provide complete

executive summaries and PowerPoint presentations, in paper or HTML formats.

Customers have 24/7 access to their data via our web servers.

Full Service Research Fieldwork and Reporting |

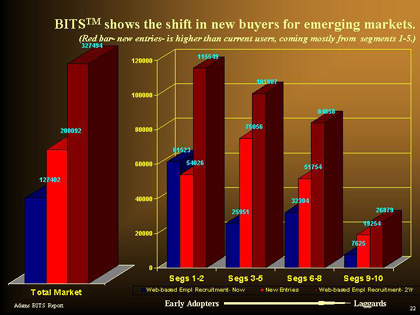

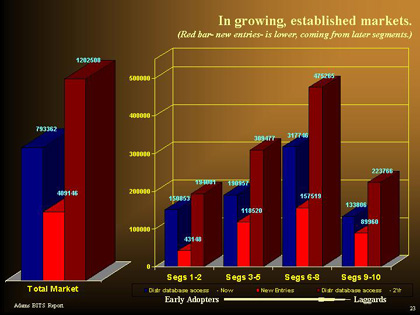

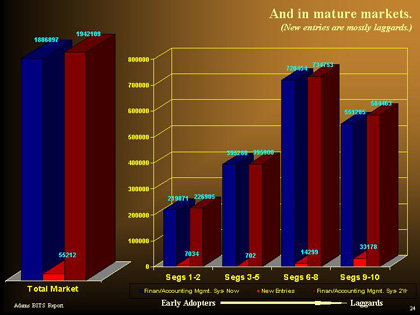

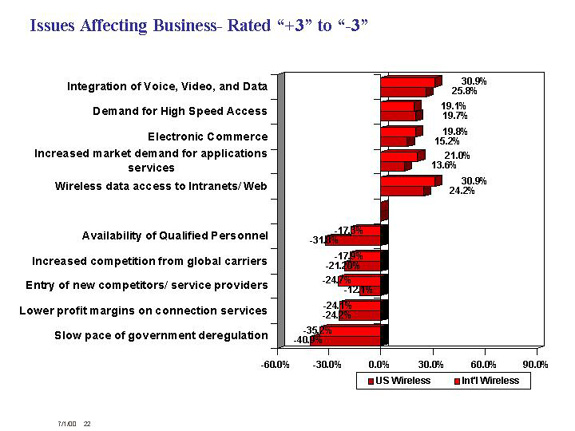

The graphs below are examples of how we have expressed market potential

or market value for our clients. The example below is set in the context

that customers' buying criteria and market point of view change as products

move through the adoption cycle: this creates an inherent opportunity for

those who can anticipate where new buyers are coming from. Across

the page, we look at market conditions affecting infrastructure decisions

and show a simple crosstab in a brand tracking study that can illustrate

the strength of marketing relationships through customer ratings.

Target Markets and Buying Criteria Change as users move down the Adoption Curve: As businesses progress down the curve, their buying values- e.g., what they're willing to pay for- change from strategic advantage to cost consciousness and need for higher levels of vendor support. They are less willing to use new vendors and are more likely to be influenced by "large brand" reputation. The transition across segment groups identifies new marketing opportunities and challenges for companies trying to build market share in an expanding market.

Markets Conditions affect Business Investments: The graph below is an example of moving outside of traditional product-related issues to document business and regulatory conditions that affect business decisions. In this case, incumbent telecommunications carriers quantify environmental issues that set the stage for their infrastructure investments. Marketers who understand these issues can use them to present their product solutions in a more compelling context.

How do you expect the following

issues to affect your company's business during the next two years?

(Ratings of criteria using a -3

to +3 scale, from 'Significant Negative Impact" to "Significant Positive

Impact".)

Source: Global Telecommunications

Carrier Study conducted for N+I, Intertec Publications

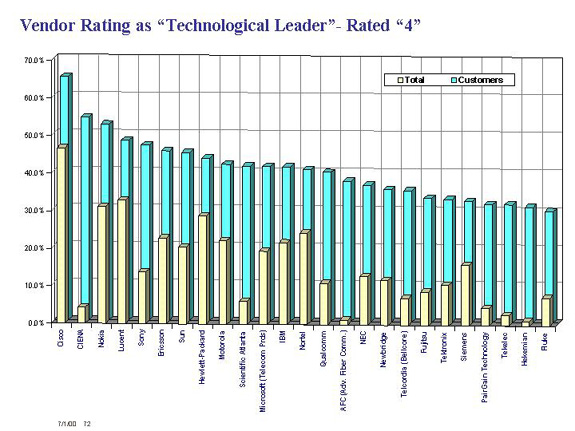

The Customer- The First Measure of Potential: The analysis below overlays a customer analysis over a standard brand ranking chart (the white bars show industry-wide brand scores for the attribute "Leader/ Creator of Technological Advances" while the gray bar shows customer ratings). For small and large vendors, it captures the strength and weaknesses of customer relationships. It can signal an internal issue that needs to be addressed or highlight a competitive opportunity to exploit.

Vendor Ratings for "Leader/ Creator

of Technological Advances"

Rated "4" ( 1= "Poor Performance"

to 4= "Exceptional")

Adams "ETA" (Emerging Technology Adoption) Research- Business IT and Electronics

Our syndicated ETA (Emerging Technology

Adoption) Studies are new, comprehensive industry surveys that profile

adoption patterns for dozens of new technologies being introduced into

the Electronics OEM (design engineering) and Business Information Technology

markets. Applications of the data include market sizing, trending, brand

tracking, purchase criteria analysis, and ad media planning.

Each industry report blends purchase

patterns and market data covering a full range of criteria, such as buyer

end-product, job function, sales, spending, etc. Beyond that, our technology

segmentation analysis evaluates business "motivations" and quantifies market

trends for emerging technologies.

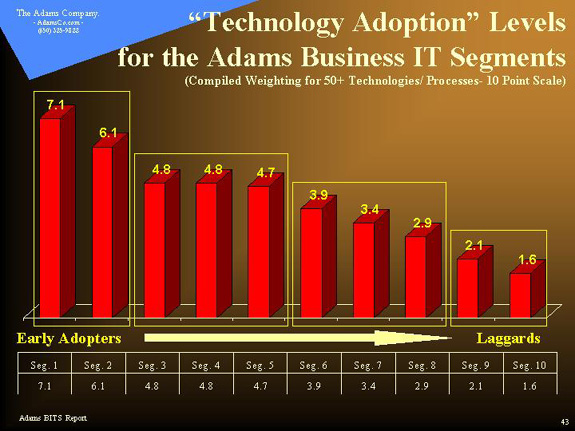

One Variable that Summarizes 100: ETA Segmentation

Our ETA reports apply a process

we developed for our recent Business IT Segmentation (BITS) Study. Our

goal was to create a new way of identifying market potential among Information

Technology decision influencers at larger, high-end business locations.

The BITS system identified an extraordinary correlation between market

clusters based on business “attitudes, motivations, and environments" and

real world technology use and purchase plans. Ten segments, labeled “Segment

1” through “Segment 10,” were created and ranked in terms of their technology

usage potential, with lower numbers corresponding to early adoption. Designed

to be "predictive," the early adopter segments are ten to fifty times more

likely to be buyers of new technologies than those who come at the end

on the adoption curve. The composition analysis below summarizes responses

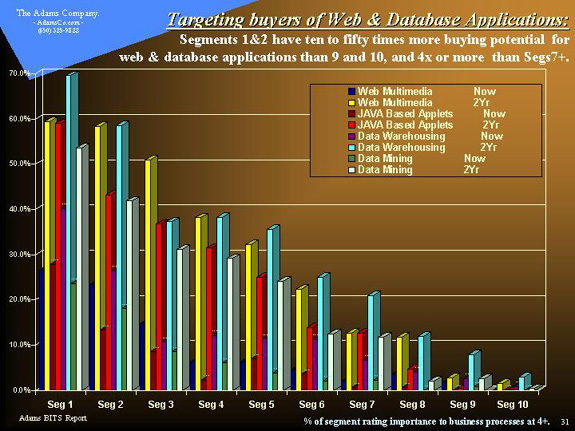

for four of the 40+ measured emerging technology categories in that study:

Composition Analysis: Importance

of Technologies to How Organization Conducts Business Operations

(Percent of Segment Rating the Importance of the Technology

or Application at "4" or "5" on a Scale of 0= "Not in Use" to 5= "Very

Important")

| Type of Site | Seg 1 | Seg 2 | Seg 3 | Seg 4 | Seg 5 | Seg 6 | Seg 7 | Seg 8 | Seg 9 | Seg 10 |

| E-Commerce - Now | 47.2% | 41.1% | 16.7% | 14.3% | 11.7% | 13.4% | 8.0% | 3.3% | 2.8% | 1.7% |

| E-Commerce - In 2 Years | 74.7% | 74.0% | 48.8% | 44.3% | 48.0% | 35.0% | 27.2% | 19.8% | 13.3% | 4.6% |

| Business Purch/Order v Web- Now | 45.3% | 30.7% | 15.0% | 13.3% | 9.3% | 15.6% | 13.9% | 4.7% | 2.3% | 2.9% |

| Business Purch/Order v Web- In 2 Years | 73.5% | 61.4% | 38.1% | 46.7% | 41.5% | 39.6% | 34.3% | 22.0% | 15.9% | 11.5% |

| Web Multimedia - Now | 26.6% | 23.5% | 14.8% | 6.3% | 6.3% | 4.6% | 2.0% | 3.6% | 1.8% | 0.0% |

| Web Multimedia - In 2 Years | 59.5% | 58.4% | 50.9% | 38.1% | 32.2% | 22.3% | 12.6% | 11.7% | 2.9% | 1.5% |

| Data Mining - Now | 23.6% | 18.1% | 8.6% | 6.1% | 3.9% | 2.1% | 2.3% | 0.0% | 0.8% | 0.0% |

| Data Mining - In 2 Years | 53.7% | 41.8% | 31.2% | 29.1% | 24.2% | 12.5% | 11.9% | 2.1% | 2.6% | 0.4% |

The application of the market segments yields a tremendous increase

in target audience buying potential. For example, a "traditional" target

audience of IT professionals in companies with 1000+ employees might have

twice the buying potential as average. By adding the adoption segment variable

- IT pros in 1000+ employee companies, who are also in the early adopter

and early implementer segments - the resulting target group is typically

five times more likely to buy.

Industry Panels and the ETA Reports

Each year, we make thousands of mail and phone contacts to qualify people to be in the research samples for our syndicated studies. For the Business IT study, we target "Alpha Influencers"- people who are identified as the primary technology and brand selection decisions makers for their company or business unit. For the Electronics OEM study, we qualify electronic design engineers, engineering managers, and other brand decision makers for OEM design and purchase decisions.

This year, for the first time, we are inviting the people who have been

qualified for our syndicated studies to participate in our new industry

research panels. The value to our clients: they are pre-qualified

and can be selected based on any number of criteria- including, in some

cases, their position on the adoption curve. We are jealous of their

value: we limit studies to them to just a few each year.

"Added Value" Research: Comparative Research vs. Syndicated Industry Norms

Primary sponsors of our syndicated industry ETA studies receive a built-in

custom research project that offers more value to their use and interpretation

of the industry wide findings. This add-on proprietary research project

can come in one of two forms: we will field a customized version of the

ETA questionnaire over 500 of the primary sponsor's customers and prospects,

or we will field a custom questionnaire to a pre-qualified subset of up

to 300 professionals in our industry panel. In either case, this

provides a new, dynamic way to assess market information: comparing proprietary

results to industry norms.

Background: The Adams Company (www.AdamsCo.com)

For over 10 years, the Adams Company has been a nationally recognized supplier of primary research for technology companies and media. The research firm specializes in market definition studies: our projects range from global telecommunications to local area networks, and from semiconductor computer-aided engineering to OEM channels. Recent custom projects addressed E-Commerce, enterprise database management, and Web usage by information technology professionals.

Our new Electronics ETA (Emerging Technology Adoption) Research Series builds from our syndicated Electronics market studies released in 1996 and 1998. Subscribers included EE Times, EDN, Electronic Design, IEEE Spectrum, Electronic Products, and other major publishers in the Electronics market; other clients have included Intel, Hewlett Packard, Amp, J. Walter Thompson, Anderson Lembke, DSW/ RSCG, etc.

Our Business IT Emerging Technology Adoption Series extends from our Business IT Segmentation (BITS) project, which was released in 4th quarter 1999. This research pioneered a new analysis of motivational and organizational patterns to put the "Alpha Influencers" of the business computing market on the "adoption curve." The analysis involved the creation of a system to measure corporate motivations, environments, and business conditions and identify how they predict the early adoption of emerging technologies in communications, E Commerce, and many other business and web applications. Subscribers to our syndicated IT studies have included The Wall Street Journal, Business Week, and all of the major IT technology publications, as well as agencies and manufacturers.

The Adams Company offers a full range of research services, from market

studies to subscriber studies, and including phone, mail, and web based

methodologies. On a consulting and marketing level, the Adams

Company develops custom market studies and analyses for manufacturers and

publishers, focusing on identifying market potential in product use, brand

awareness/preference, and evaluation of buyer ratings of features and benefits.

Categories have included:

| Telecommunications Carriers | Web Use by Information Technology Professionals |

| Electronic Commerce | Database Management/ Warehousing |

| Computer Distribution Channels | Seminars/ Event Attendance/ Perceptions |

| Enterprise Networking | Microprocessors |

| Board Level Computer Products | CAE/ Electronic Design Automation |

| UNIX Brand Recognition Study | Manufacturing Information Systems |

Because of an established expertise in presenting advertising media

audiences and defining market potential, the Adams Company has conducted

subscriber profile and market studies for a variety of technology publications,

media companies, and manufacturers of technology products. Some of our

clients are listed below:

| ZD Expos (COMDEX, N+I) | LAN Times | Fujitsu |

| C Net | Network Equipment Technologies | Racal Vadic |

| National Advanced Systems | Valid Logic Systems | Personal Computing |

| CMP Channels Group (CSN, CRN) | Communications Week | UNIX World |

| Electronics Magazine | Electronic Design | Open Computing |

| IEEE Communications Magazine | Intertec (Telephony, Cable World, etc.) | Ask Computers |

We created WorldInquiry.com for global and web-based fieldwork and have implemented direct client access to our servers so clients can have real-time access to their data.

For more information, see our web site or contact us at

The Adams Company.

1420 Middlefield Rd.

Palo Alto, CA 94301

(650) 325-9822

E-mail contact: jadams@AdamsCo.com