Adams Business IT Segmentation (BITSTM) Study

Copyright 1999- 2001 By The Adams Company. Palo Alto, CA. (650) 325-9822. Adamsco.com.

Only one syndicated IT study identifies the Highest Potential Buyers

By Looking at Corporate "Psychographics" and Technology Needs

Click here to Download PDF summary of study

Click here to start slide show

Home

The BITS

TM

Segmentation System Goes Below the Surface and . . . . . . . . .

|

1.

|

BITS is the only syndicated study that is specifically designed to look at how businesses differ in their IT needs, purchasing patterns, and adoption patterns for emerging technologies.

|

|

|

|

2.

|

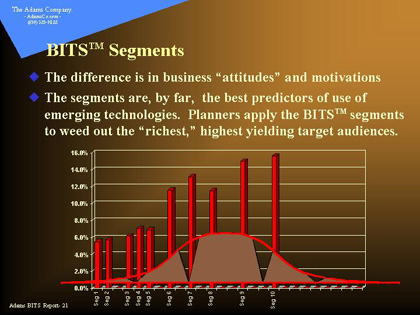

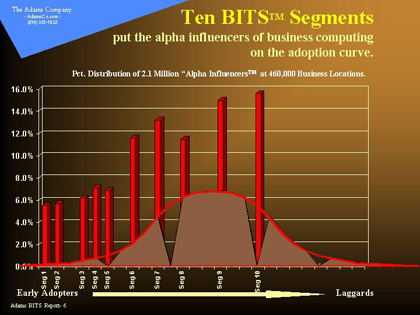

BITS uses a unique, proven analysis of business environments, attitudes, and competitive motivations to identify ten market clusters, or segments. Each has distinctly different needs and perspectives about technology. We ranked them by how intensely they use emerging technologies, effectively positioning each segment on the "adoption curve."

|

|

|

. . . . . . Uncovers Target Groups with Dramatically More Buying Potential

|

3.

|

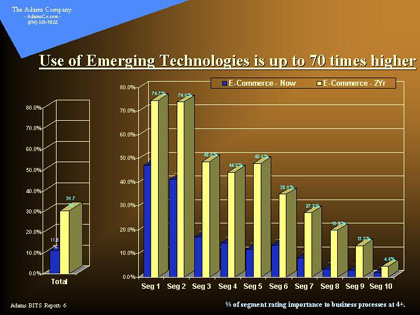

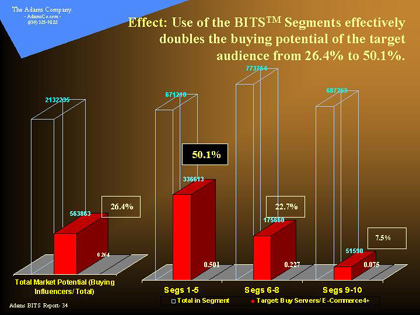

The segments let planners integrate business "attitudes" into IT target audiences. By combining purchase involvement with business unit need, adoption segments, and "C-Level" management authority, brand and media planners define the most potent buying audience to use in marketing and media planning. The example above is for E Commerce Servers.

|

|

|

|

4.

|

4. Bottom Line:

BITS doubles the buying potential of the target audience. Ad recommendations now direct more "hits" to the people most likely to buy- more often, more effectively, and more efficiently.

|

|

|

BITS goes a step beyond the planning and media analysis capabilities of IntelliQuest CIMS or MRI. It uniquely applies market segmentation to uncover business "personalities" and motivations towards using information technologies in their business strategies. BITS reveals more focused, higher-yielding advertising targets: advertising and media strategies are significantly improved.

People should still use the other studies when they they're looking to cover "everybody" who is involved in the computer market. But for high-end business systems, "New Economy" applications, and emerging technologies in networking, databases, and communications, the Adams BITS research is far superior. Here are four key points:

1. Only BITS uniquely applies market segmentation to go below the surface. It analyzes business "attitudes" and motivations to find the factors that predict heavy and early use of leading edge information technologies and Web related applications.

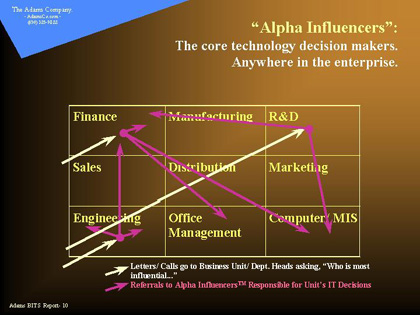

2. Only BITS focuses on the high-end: the "alpha influencers" at the "alpha" business sites, the top 5% of U.S. business locations. BITS also has the best methodology for finding the "C-Level" (senior and executive management) influencers who determine IT strategies, no matter what their title is or where they are in the organization.

3. BITS is the only study that lets media planners put their target audience on the "adoption curve." In particular, the "early adopters" are strategically critical: they buy first, they spend the most, and they directly influence sales to the large majority markets.

4. Finally, BITS is cost effective. The benefit- it's ability to double planning accuracy for early adopters and high potential buyers- is delivered at a fraction of the cost of a typical ad page.

|

BITS is used with standard ad planning software from IMS, Telmar, etc., so planners can drill down to get the data that meets their specific needs. Brand planners use the research to more effectively guide ad programs and set strategies. Media planners use average issue readership measurements of 30 business and technology publications and 30+ media web sites to get maximum impact from advertising expenditures for new economy and emerging technology targets.

|

Methodology: Executive Summary

BITS uses an innovative, proven methodology to find the "alpha," top-level decision makers for IT at the business unit level. The first four steps create the sample; the fifth is the mail survey fieldwork.

|

|

1.

|

A high-end, stratified sample of 5,000+ companies is drawn from the D&B database of 11 million locations.

Represents 460,000 locations:

* All locations with over 50

employees &

* Business services with 10 to 49

employees.

|

|

2.

|

For each target site, a population of business units/ departments is created by identifying department heads and executives.

Two list sources:

* ALC Executive Masterfile

* Dun's Senior Executives

Individual sites have 1 to 60 senior manager/ executive contacts. Each contact represents the head of a business unit.

|

|

3.

|

The heads of the business units (or associates) are contacted by

mail, phone, or web to identify "alpha influencers" for the unit.

(Note: its their job to know who's been delegated this responsibility.)

Screening Question: Who are the people most responsible or

influential in deciding what kinds of computer systems are used

in your area of responsibility? For Networks or the Internet?

(This question defines the "alpha influencers".)

|

|

4.

|

The "Alpha Influencer" sample is drawn from the people named as

the "most responsible" decision makers for their business units.

|

|

5.

|

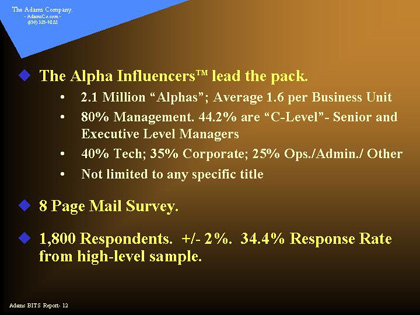

An 8-page

survey is sent to the Alpha Influencers. The 1999/2000 survey

had 1800 respondents, with a strong response rate of 34% from a predominantly

management sample. The 2001 study is projected to have a response base of 2,000 and a 40% response rate. Reliability for the

data is +/- 2%.

|

|

|

The "Alpha" Purchase Influencers:

"C-Level" and Management Technology Decision Makers for the High-End of the Market

The "Alphas" are the most critical brand decision makers at the high end -- the top 5% of U.S. sites- of the business market. Like "alpha wolves," they lead the pack. Some of their characteristics are below:

|

1.

|

There are 2 million+ "alpha" decision makers.

|

|

2.

|

They are top level management. 44% are "C-Level" decision makers, or senior and executive level management, including senior VPs, division heads, and other critical strategic business decision makers. 80% are mid-management+. Importantly, the research lets planners identify the C-level target by function, rather than title. These are the people who are responsible for technology strategies for their companies or business units.

|

|

3.

|

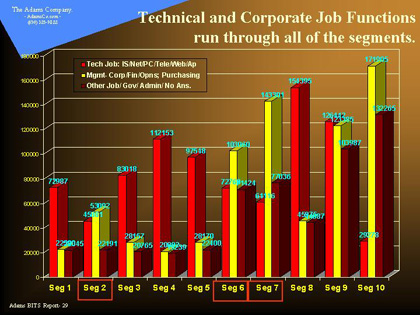

They can be anywhere in the organization. About one-third note an IT-related function as the "single best" description of their job; corporate, financial, and operations management make up about 40%. Where multiple job functions could be chosen, about 60% (1.3 million) are what could be called "computer professionals."

|

|

|

|

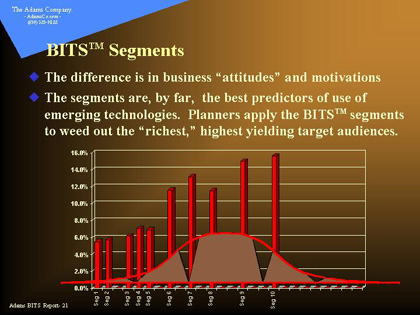

What the BITSTM Segmentation System discovered about technology adoption:

Technology adoption is fundamentally a management business strategy. There are clear, definable differences in how businesses approach risk and commitment to technology. Critical issues are management’s support of technology, their allocation of resources- money, training, and time- and whether the alpha influencers see their company as technology focused. Other things affecting technology adoption: the employee work environment, product development and competitive pressures, what customers and suppliers need, and so on. The research also shows that technology adoption can't be predicted by job function, company size or product, or any of the traditional descriptions of business buyers.

Bar none, the BITS segments are the most effective variables for predicting technology use. Because they are based on motivations, not surface characteristics like company size or end-product, they give planners the tool to get maximum ad impact on the most likely buyers.

|

|

1.

|

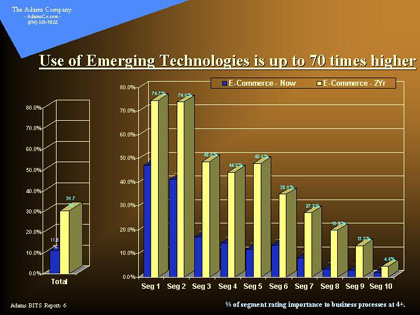

The ten segments are ranked by how heavily they use emerging technologies and applications. Segment 1 has higher usage than Segment 2, and so on. The bars on the chart show the size of the segments.

|

|

|

|

2.

|

BITS segments identify targets up to 70 times more likely to buy, even where company size is the same, and job functions are identical. That's because it takes into account technology adoption as a business objective and a business strategy.

|

|

|

|

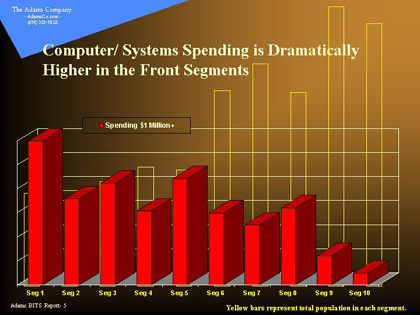

3.

|

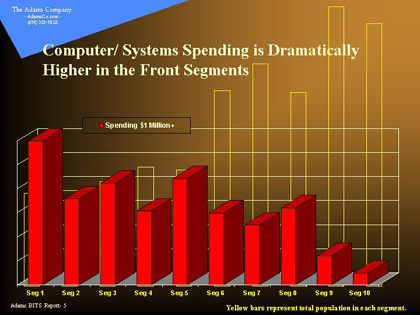

They not only use the most technology, but they are the most valuable customers. They are the highest spenders and heaviest users.

Taken together, segments 1 through 5 represent about one-third of the total alpha influencers, but make up 60%- 80% of the market for emerging technologies. Focusing on this group increases ad media impact, efficiency, and minimizes waste.

|

|

|

BITSTM and Media Planning

BITS segments and technology usage ratings can be combined with standard criteria for job function, purchase involvement, and so on, so ad planners have complete flexibility to identify and target programs to the highest potential buyers. Readership measurements for some of the 30 business and technology publications in the study are shown below.

Another example, showing BITS applied the "C-Level," E- Commerce server target audience described earlier, shows technology and business publications are both important for reaching the alpha influencers. Planners have a more effective way to create the best media mix.

Two points summarize the value of BITS in media planning.

|

1.

|

BITS dramatically increases the ability to target advertising compared with other studies. It also helps ad strategists to more effectively allocate advertising between corporate and technical titles.

|

|

|

|

2.

|

No other study directs advertising as effectively to high-end IT buyers.

|

|

|

|

Adams Business IT Segmentation Study: Subscription Information

1999/2000 BITS Study

The 1999/2000 BITS Study was released at the end of the fourth quarter, 1999. Data from the study continues to effectively capture buying and media usage patterns for the Business market, for both the adoption segments and emerging technology categories. The subscription gives direct access to the media database using analysis software offered by companies such as Telmar, IMS, or New Age Media.

The cost for advertisers or agencies is $11,895. Subscribers also receive a 25% discount on a subscription to the 2001 BITS study.

2001 BITS Study

Currently scheduled for a May 2001 release, the next BITS study will include the addition of "New Economy" publications, more Web media categories, and brand awareness/ rating measurements for five key product groups. The study will be offered for four market categories that can be subscribed to individually for $7,200. A subscription for all four categories is $17,950.

2001 BITS- Customized Research Opportunity

Primary corporate subscriptions are available for eight subscribers. The opportunity is for a vendor or agency to work with the Adams Company to customize the BITS project by re-contacting respondents to the syndicated study, or by using the BITS segmentation system to better understand the company's own customer or prospect base. The $34,000 subscription cost includes the full 2001 BITS Study plus a custom follow-up research study to up to 300 members of the BITS Alpha Influencer panel. Alternative custom research projects can also be designed and costed out as requested.

|

The Adams Company

(www.AdamsCo.com/ 650-325-9822)

Custom & Syndicated Research // Domestic, Global, & Cyberspace

Founded over ten years ago by a veteran ad agency media and research executive, the Palo Alto based Adams Company specializes in syndicated and custom technology market studies: our projects range from global telecommunications to local area networks, and from semiconductor computer-aided engineering to OEM channels. Recent custom projects addressed E-Commerce, enterprise database management, and Web usage by information technology professionals. We also now offer custom research licensing the our proprietary BITSTM segmentation system.

The Adams Company's new field service, WorldInquiry.com, conducts domestic and global Internet-based research projects.

Our series of syndicated high-technology market and media studies address the Information Technology and Electronic OEM markets. Subscribers to our Information Technology studies have included the Wall Street Journal, Business Week, Computerworld, Network World, CIO, Information Week, Communications Week, PC Magazine, PC Week, LAN Times, and others. Our ad agency and marketing clients have included Intel, Hewlett Packard, Dell, J. Walter Thompson, Chiat Day, Anderson Lembke, DSW/ RSCG, etc.

|

|

|

| |